By Benjamin Szweda

Have you hired anyone lately? If so, by law, you are required to complete Form I-9 within three business days of the employee’s start date. In this blog post we’ll walk you through how to do that accurately and timely to avoid being assessed fines during an I-9 Audit.

What’s this form all about?

Form I-9, Employment Eligibility Verification, is used to verify employee identity and employment eligibility to work in the US. Anyone who will get a W2 at year end, must complete an I-9 upon being hired. There is no waiver for small companies, however 1099 workers and volunteers are not required to complete this form.

Method of Completion

This form can be completed on paper or electronically. If you use Gusto payroll services, you may see this reminder on the dashboard of your account after hiring new employees.

This alert means that during onboarding, your employee completed Section I of the I-9 and that it is now time for the employer to complete Section II.

How to Complete the I-9

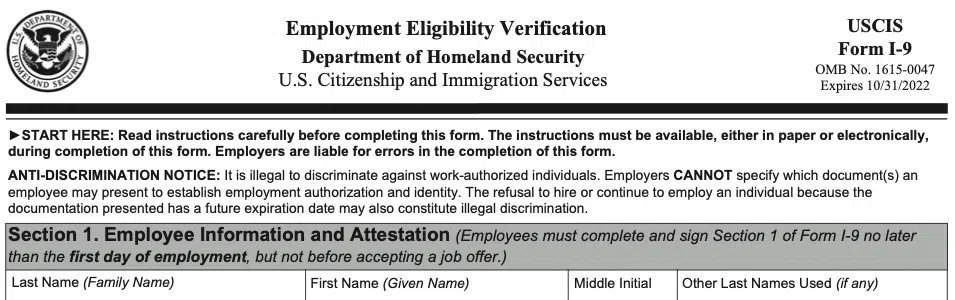

Section 1

This section of the form is to be completed by the employee. Every field shown on the form is a required field. This section must be signed and dated by the employee.

Most importantly, this section must be completed by the employee no later than the first day of employment. The form can be completed earlier, but not prior to the employee accepting a job offer.

If using Gusto payroll services, the employee will be given an opportunity to complete this section of the form digitally when doing onboarding.

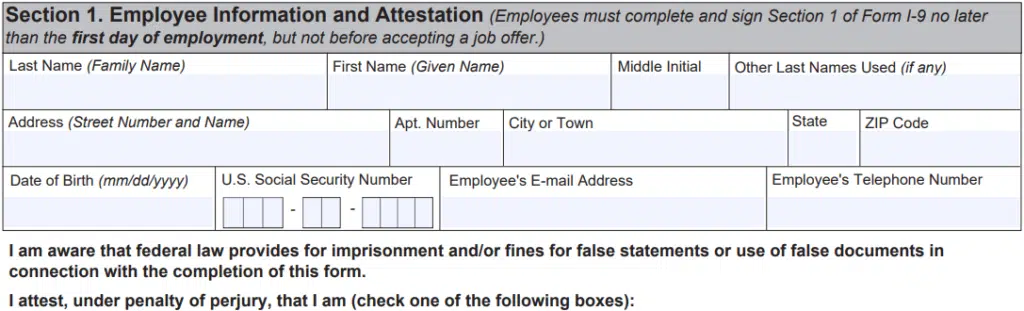

Section II

This section must be completed by the employer or their authorized representative. This section must be completed within three business days of the employee’s first day of work. It is best practice to have the employee bring with them the required documentation on day one.

Gusto will send a reminder to employees prior to their first day of work asking them to bring with them the identification documents necessary to complete Section II.

Employers cannot specify which document(s) the employee must provide. Employers can however provide listings to employees so they know which documents are allowed.

Employers must complete all fields in this section of the form. While not all documents will have all information (e.g., expirations dates), all available information must be recorded and employers must sign and date the form.

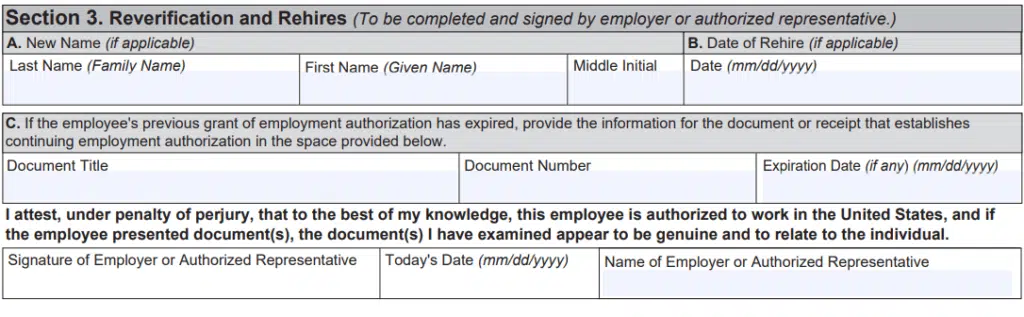

Section 3

There are I-9 requirements when re-hiring a previous employee. If the person was rehired after three years, a new I-9 form must be completed. If the person is rehired before that three year mark, you can opt to complete a new form, or you can complete Section III.

This section simply collects a signature if the employee remains employment authorized. If documents have expired, they can be updated in this section.

Audit

Your I-9 records can be audited by the US Immigration and Customs Enforcement agency (ICE). If you are going to be audited you will receive a Notice of Inspection (NOI) in the mail and have at least three days to provide the requested information.

If any errors are found in the records, you will be given another ten days to make corrections. Note that fines can be issued for noncompliance so it’s important to take the time to fill out Form I-9 correctly when hiring new employees.

If you are worried your forms don’t live up to the requirements, the best way to be prepared for an ICE Audit, is to perform an Internal Audit of your I-9 records or hire a professional to perform this task for you.

You should save completed I-9 forms in a file separate from your employee’s standard records. Completed forms should be on hand for all active employees. For terminated employees, forms should be kept for the longer of either three years from the first day of employment or one year from termination.

Ensure Compliance with an Internal Audit

Review your own files. Get a list of all active employees, and ensure that you have an I-9 on file for each employee. If you don’t, contact your employees, and get the form accurately completed immediately.

If you notice errors on the I-9 forms of current employees, gather the necessary information to make corrections. Use a different color ink to make the corrections and put the current date near the correction. When making a correction or completing an I-9 late, use the date of the correction on the form. Do not back date forms. More information about conducting an internal review of your forms can be found here.

Download the latest version of the form here.

Szweda Consulting does not provide legal advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice, and is not to be considered an exhaustive resource on the topic presented. Contact us individually, or your personal tax, legal, or accounting advisor before engaging in any transaction.