We offer payroll solutions to support single-member S-corps as well as large companies.

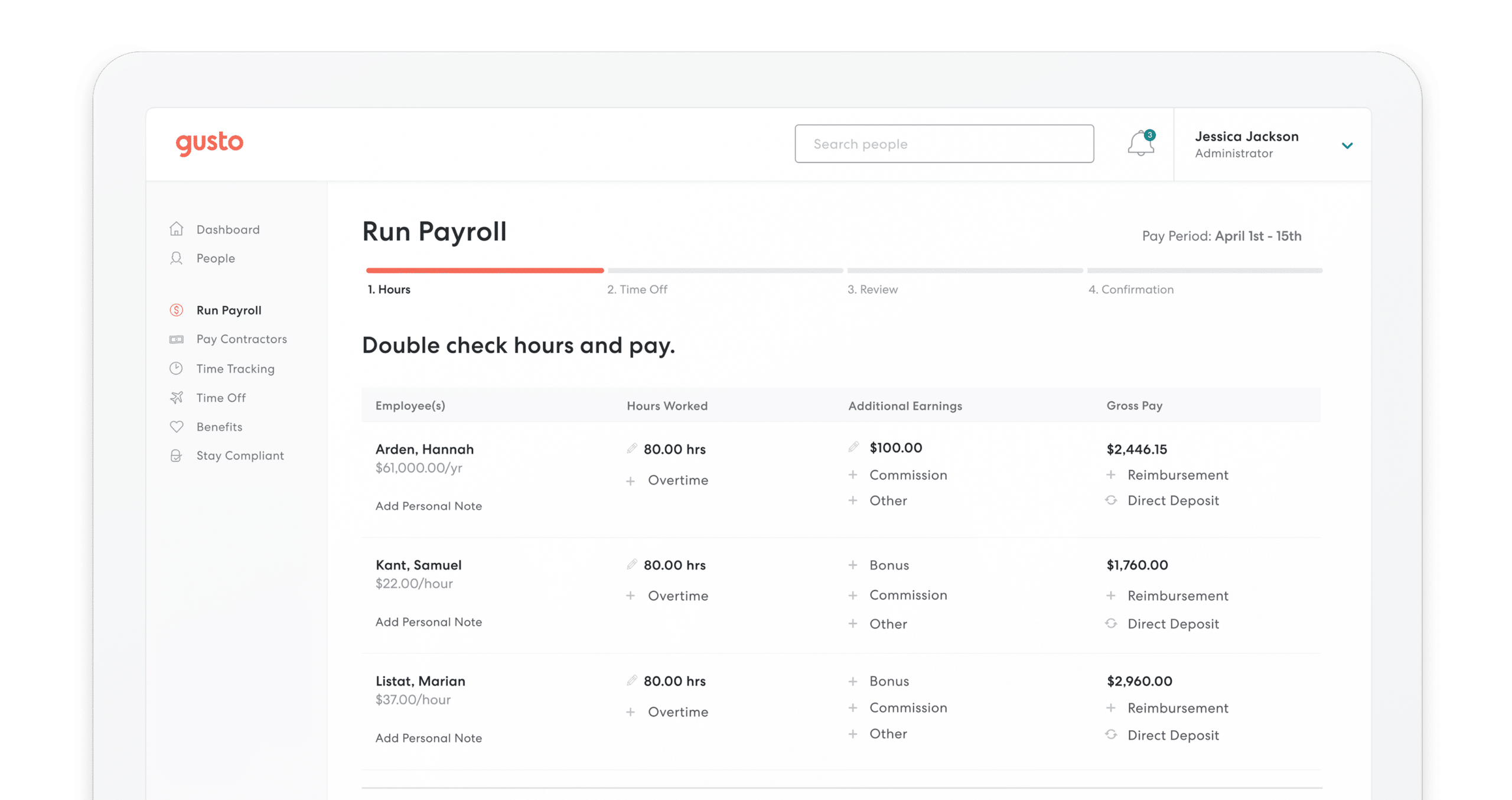

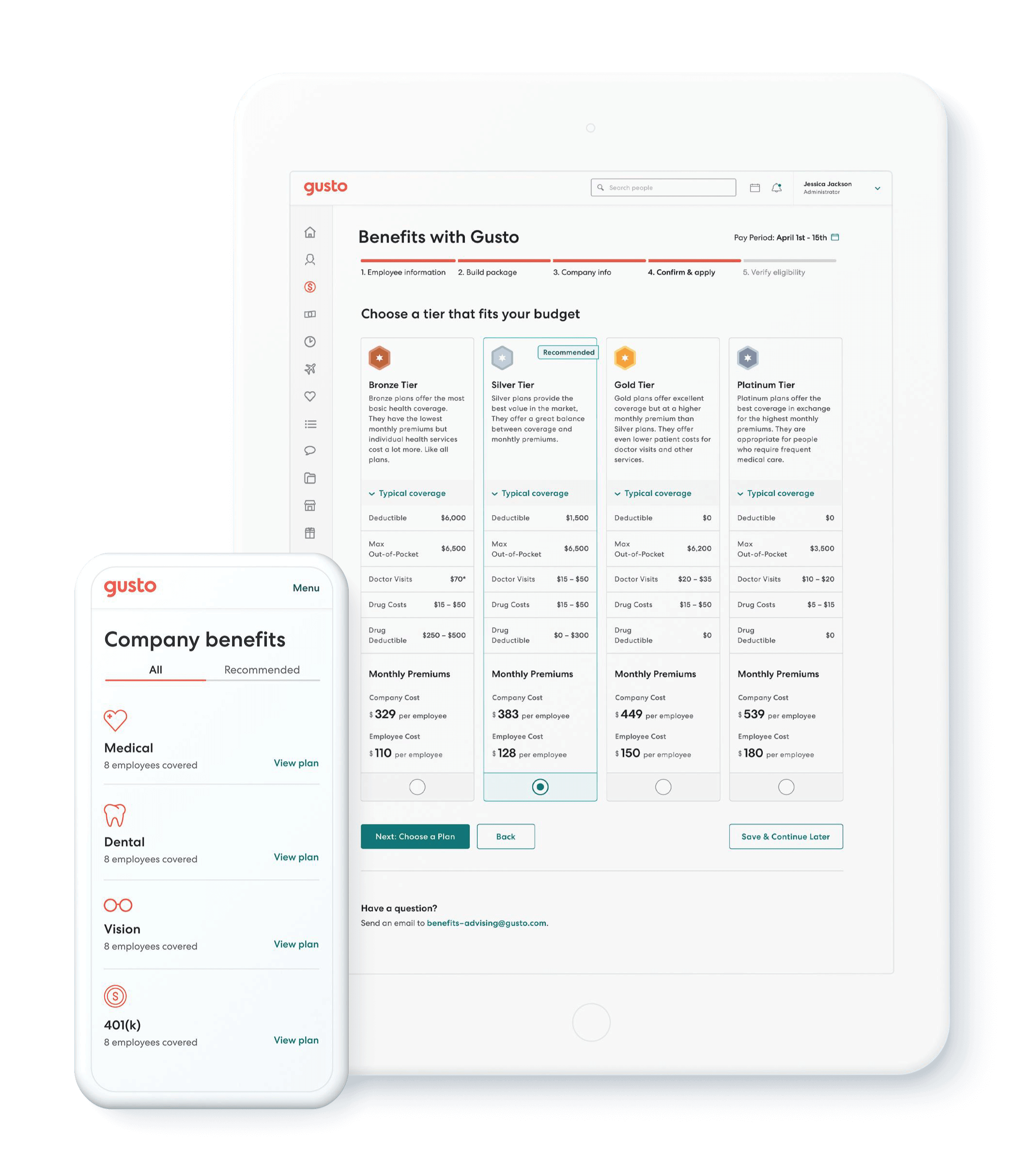

Whether you have to run payroll weekly or monthly, we can fully manage your payroll needs. Using a payroll service doesn’t mean calling hours into a third-party vendor. We handle the entire process for you, including time tracking, PTO tracking, calculating commissions, ensuring benefit deductions and garnishments run correctly, and more. This service can be provided on an ongoing basis, or we can help set the system up for you.

If you’ve never run payroll before, we can take care of registering your business for state income tax withholding, a state unemployment account, and all other government requirements. When you work with us, all tax filings and payments are handled for you, including city taxes, if applicable. This way, you never fall behind or pay penalties.

Year-end W2s are available for employees online or can be mailed. At year-end, we also ensure contractors receive Form 1099-NEC. For Ohio clients, we’ll provide the reporting you need for your worker’s compensation insurance true-up in August, all included within our payroll services offerings