QuickBooks – What Account Type To Select?

Cost of Goods Sold? Expense? Other Expense? How to Choose. When creating new accounts in QuickBooks Online you are faced with a decision – what Account Type to select. Sometimes the decision is obvious, but for many transactions there can appear to be more than one correct answer. The most confusion comes when deciding between Cost of Goods Sold (COGS), Expenses, and Other Expense.

Does Account Type Matter In QuickBooks?

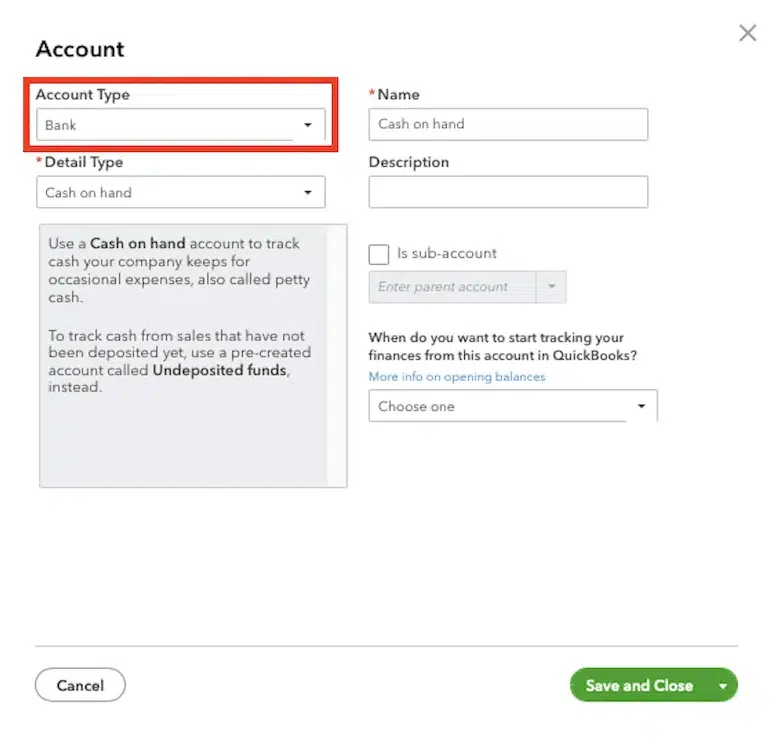

The Account Type in QBO is so important because it determines how the software will treat the transaction. It determines whether it is a balance sheet or an income statement account. It determines whether it goes at the top or the bottom of the income statement; whether it is considered part of COGS or SG&A (i.e., sales, general and administrative expenses).

The Detail Type field is less important, though toggling through the options will show you a brief description of what types of transactions belong in that category. Do note that in the future should you wish to merge accounts together, the Detail Type is one of the fields that must be identical before two accounts can merge.

Transactions relating to labor and materials can be considered COGS and other times they can be considered SG&A. To help you decide let’s review some definitions.

What is Cost of Goods Sold in QuickBooks? (COGS)

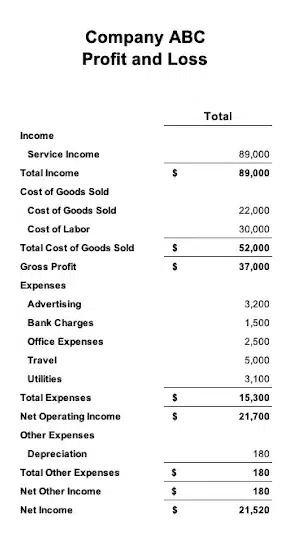

On the services side of things, this could be software subscriptions that you (re)sell to clients or advertising you purchase on their behalf in the case of a marketing firm.

For example, when Szweda Consulting pays on behalf of clients for subscriptions to QuickBooks, Bill.com, TSheets, Gusto, or other software, we record these costs above the line on our Income Statement.

Labor can also be considered above the line cost. The wages and associated costs of staff on the assembly line, repair technicians, and chefs all could logically be considered a direct expense.

What Are Expenses in QuickBooks?

Expenses are the indirect costs of the business, whereas COGS are the direct expenses related to what you sell. SG&A Expenses include sales and advertising costs; overhead, such as utilities or rent; office supplies; taxes; and the bills you receive from Szweda Consulting. While these are necessary costs, they don’t directly produce revenue for your business.

Labor can also fall under expenses. Supervisory and ancillary staff are often accounted for below the line.

Other Expenses in QuickBooks

Other Expense is a useful category for things you do not want to factor into the Net Income calculation. These can include depreciation and amortization and gains and losses.

A sample Income Statement to demonstrate these points appears below.

Contact Szweda Consulting With Any Questions

If you have any other Income Statement questions, please contact us about our bookkeeping services for small businesses at (216) 509-1561. If your P&L doesn’t look like the one above then let the best bookkeeper in Cleveland help you clean up your QuickBooks account and set it up for future success.