Whether you are a new or returning client, or just searching the Internet for helpful advice, here are the initial items that all clients will need to provide in order to have their individual taxes done.

There may be other items specific to your tax situation, but this is a good starting list to cut down on preparation delays. Some items may not apply to you.

Identity Items

The following forms of identification are needed:

- Social Security Number (SSN)

- Spouse’s name and SSN

- Photo Identification for you (and your spouse)

If you are claiming a dependent on your tax return the following additional items are needed regarding your dependents:

- Dates of birth

- SSN

Income Items

Forms W-2 will be needed for all employees individuals.

If you are allocated a percentage of a partnership or S Corporation’s income a Schedule K-1 will be needed as well.

1099s

- 1099-G (unemployment payments)

- 1099-NEC (contractor/self-employment income)

- 1099-R (retirement income)

- 1099-SSA (social security income)

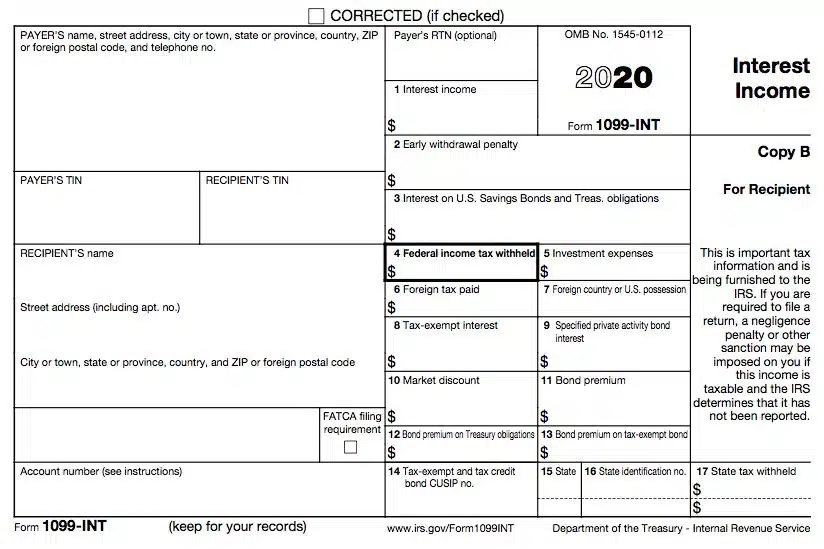

- 1099-INT (interest income)

- 1099-DIV (dividend income)

Rental Income

If you rent out a house or part of your own home we’ll have to complete Schedule E. To do so we’ll need to know:

- Rent received

- Expenses such as utilities or property taxes

- Asset information such as purchase price and the date it became available for rent

Deductions

The standard deduction has increased to $12,400 for single filers, to $24,800 for married filing jointly filers, and to $18,650 for the head of household filers (as of the tax year 2020).

There have also been changes to what itemized deductions are allowed. You can no longer deduct tax preparation fees or unreimbursed employee expenses for example. Therefore, fewer people are completing Schedule A: Itemized Deductions.

If however you still plan to itemize your deductions you’ll need to tabulate these expenses. Review the current Schedule A here to see a list of eligible expenses, such as charitable donations, mortgage interest, and medical expenses.

If you’d like to learn more about Home Office Deductions and Expenses if you run your business out of your home, click here.

Miscellaneous Items

All new clients will need to provide a copy of their last filed federal, state, and local income tax returns.

Submitting Your Documents

If you are a client of Szweda Consulting we will send you a link to a secure online portal where you can upload documents to us. If you were a client last year, you have access to this portal year-round, so feel free to upload items as you receive them if that’s easier for you. For your security and privacy, we do not accept tax documents or anything with your SSN on it by email or cloud storage solutions like Dropbox.

SIGN UP FOR OUR NEWSLETTER BELOW: