W4 and Federal Tax Withholding in 2025

The IRS has released its long-awaited changes to Form W-4. This will affect both accounting and human resource professionals as …

The IRS has released its long-awaited changes to Form W-4. This will affect both accounting and human resource professionals as …

You may have heard about a recent tax deadline or about estimated taxes payment and weren’t quite sure if this …

Whether you are a new or returning client, or just searching the Internet for helpful advice, here are the initial …

The IRS has released its long-awaited changes to Form W-4. This will affect both accounting and human resource professionals as …

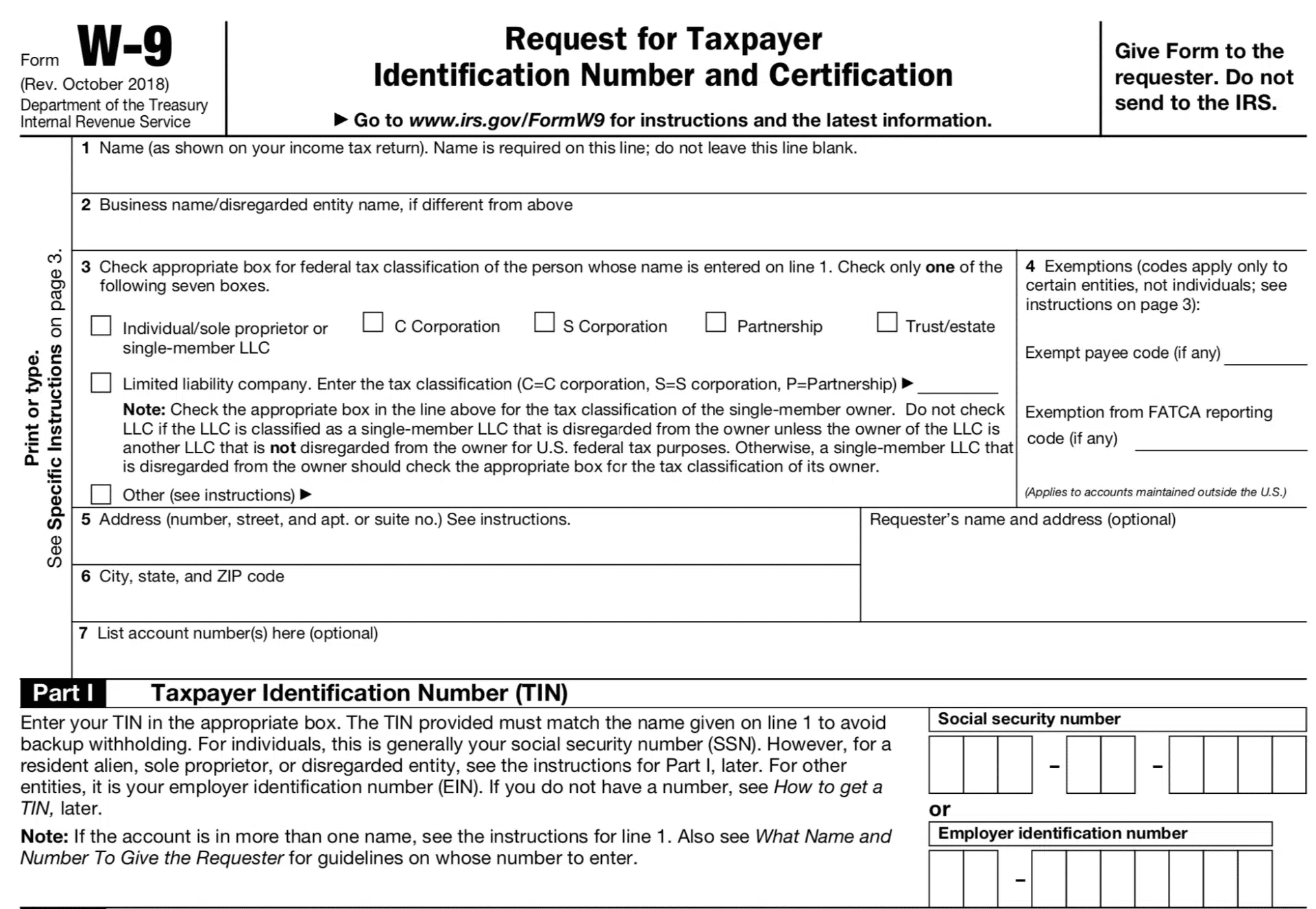

The IRS requires Form 1099-MISC to be filed for all individuals to which you have paid more than $600 in …

Top Mistakes Cleveland Business Owners make on their Taxes Business taxes can be incredibly complicated, and mistakes on your tax …

Who Gets Tax Notices and Correspondence? Tax notices only go to, you, the client. Even if an accountant e-filed your …

Tax Write Off Guide for Home Office Deductions & Expenses If you run a business out of your home, you …