How to Handle Petty Cash in QuickBooks: Retain transaction data even on small cash transactions

For those small dollar amount purchases, it is often common to use cash, whether the cash is used to reimburse employees or to pay for the expense directly. Getting cash is as simple as writing a check to cash, but how do you record the individual cash transactions? QBO makes this and reconciling your cash account easy. We’ve also added a video below in addition to other visual steps below it.

Create a “Bank” in QBO

While not a real bank, that is the account type that must be selected in QBO. To set this up in QBO, click the gear icon in the upper right of the screen and then Chart of Accounts. Click New in the upper right corner. Select “Bank” for Account Type, “Cash on Hand” for Detail Type, and click Save and Close. Your new account is now set up.

Funding the Cash on Hand Bank

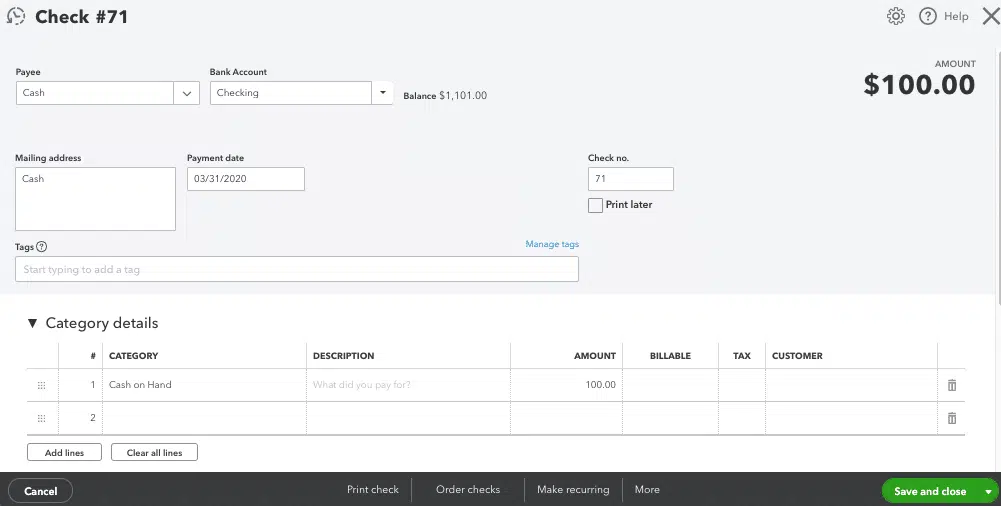

To fund your petty cash box you will likely withdraw money from your checking account. To start this process, within QBO use the check-writing screen just as you would if paying a vendor. Select the “+NEW” button in the upper-left portion of QBO and then click “Check.” Instead of selecting an expense account when asked for the Category under the Category Details section, select the name of your Cash on Hand Bank. This will debit the cash on hand account, increasing its balance. Your check to cash should mirror the sample image above.

Recording Expenses

When expenses are incurred and cash is spent it is a good idea to obtain a receipt from the vendor or a signed receipt from the employee receiving the cash. The receipts can then be routed to the person entering data into QBO. The receipts are entered into QBO as expenses against the Cash on Hand Bank account. Click the “+NEW” button and then Expense. When selecting Payment Account select the Cash on Hand Bank and fill out the rest of the expense form as normal. This time when asked for a Category under the Category Details section enter a specific expense account (e.g., office supplies or meals).

Reconciling

If your initial check to cash was for $100, at all times you should have either real cash or receipts totaling $100. When you get low on funds and need to write a new check to cash first reconcile the Cash on Hand Bank account. From the Cash on Hand Bank Register, click Reconcile in the upper right. Enter for ending balance the amount of real cash remaining. When reconciling, check off on your initial deposit and all expenses. The goal is to get a $0 difference to show in the upper right corner of the reconcile screen.

Questions about your petty cash procedures? Contact us for more information.