Recording Credit Card Transactions in QuickBooks: Many options – One best practice

Over the years I have seen many methods of recording credit card transactions. Some of the methods technically work, but they leave something out whether it is accurate dating of the transactions, detail of the individual transactions or the ability to reconcile the account to the statement. Using the method QuickBooks designed for credit cards addresses all of these shortcomings.

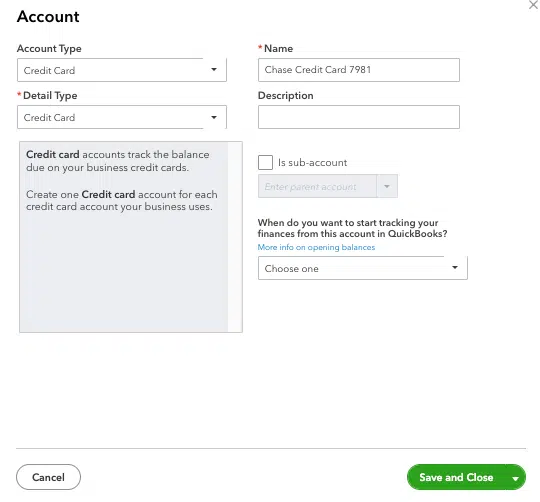

Set the Credit Card Up in the Chart of Accounts

I have seen a lot of businesses just make the credit card a vendor, but that method leads to some of the shortcomings mentioned above. Set yourself up for success and create a new item in the Chart of Accounts. In QBO click the gear icon then Chart of Accounts. Click New in the upper right corner of the new screen. Then as shown above, for Account Type select Credit Card, give it a unique name (including the last four digits of the account number), and then select Save and Close. In QuickBooks Desktop products click Company then Chart of Accounts. In the lower-left of the new screen click Account and then New. Choose Credit Card as Account Type and click Continue. Name the account and then click Save and Close.

Enter Transaction Detail

If you just enter the lump sum due to the credit card company you miss out on all the detail of the individual transactions. You will not know how much you spent with each vendor or have an accurate expense total per month since most credit card statements span calendar months. To enter the individual detail of each transaction in QBO click the “+NEW” button and then Expense. For Payment Account, select the credit card account created in the above step. For Category select the expense account that pertains to the specific transaction (e.g., office supplies or meals). In QuickBooks Desktop products click Banking in the menu bar and then Enter Credit Card Charges. As you enter each transaction use the date of the transaction and not the statement ending date.

Reconcile

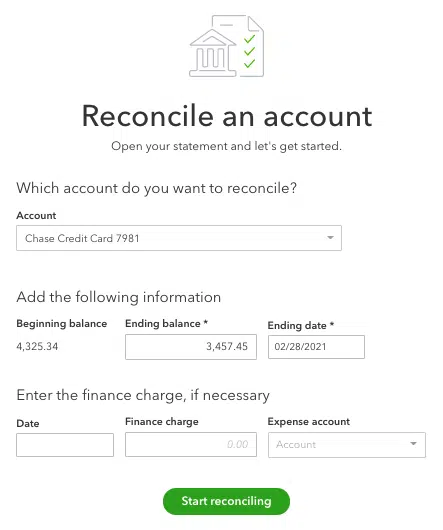

Get started by click the gear icon in the upper right of QBO. Then click Reconcile. From there you’ll see a screen like the above image. Select the credit card account you want to reconcile from the dropdown box. Ensure the beginning balance matches the statement and enter in the ending or new balance. Enter the ending date off the statement, which may not be the last day of the month, and click Start Reconciling.

Compare the transactions on the next screen to the PDF statement checking each one off as you go. The goal is to get a $0 difference between QuickBooks and the bank statement.

If you need help reconciling, setting up a new credit card or one that was never entered properly into QuickBooks drop us a line.