It’s not a frequent occurrence, but it’s happened to me three times in the past year among my various clients. The scenario is my client has an open invoice and an open bill recorded in their QuickBooks. My client’s customer, instead of paying my client directly instead sends the payment to my client’s vendor. So no money has touched the hands of my client, but somehow both their AR and AP need to decrease. What do you do?

5 Steps to Take To Clean Up Your Quickbooks Record

Step 1: Create a “Bank” Account

To get QuickBooks Desktop or Online to work with you on this one you need to create a “bank” type account in QuickBooks to use as a clearing account. You can call it that or manual bank, but the effects will be the same.

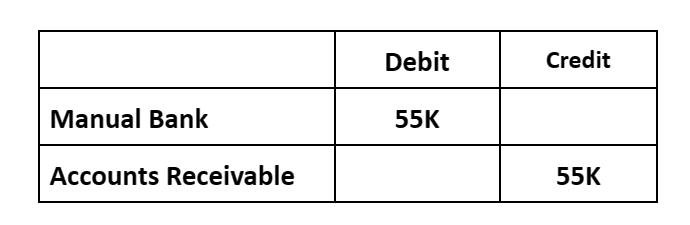

Step 2: Correctly Create a Journal Entry

This journal entry reduces your AR. When crediting AR you will need to enter in the name field the name of your customer. Create a description within the journal entry describing the situation and copy it to use in step 3.

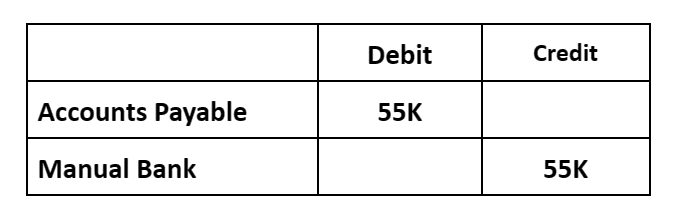

Step 3: Create Another Journal Entry

Create another journal entry. This entry reduces AP. You have to do this in 2 steps because QuickBooks does not allow AR and AP in the same journal entry. When debiting AP you will need to enter in the name field the name of the vendor that your customer paid on your behalf. Paste in your description describing the situation.

Step 4: Verify Bank Balance

Verify the Manual Bank balance is $0. Verify that the AR and AP have now been reduced by the appropriate amount.

Step 5: Post Your Entries

Within the AR model apply the JE made in step 2 to the open invoice. Within the AP module apply the JE made in step 3 to the bill. Run an Open Invoice and an Unpaid Bills report to ensure all traces of the transaction are gone from the reports. If you are seeing the transaction as both a positive and a negative number, you have not properly applied the JE to the open invoice or the unpaid bill.

Want To Speak To A Professional About Your Situation?

Do you have this or a similar unique situation that you just aren’t sure how to record? Szweda Consulting is your Cleveland certified Accounting & Business Solutions partner and we’re here to help. Call us today for at (216) 877-9015 for a FREE Consultation, and learn how we can provide you with customized plans and solutions.