There are minimum requirements when recording payroll expenses and then there are extras that you might consider including for improved reporting. If your payroll software doesn’t automatically import an entry into your accounting software every time you run payroll, you might want to consider my favorite payroll provider that does this for free. In the meantime, keep reading for an easy way to record the information you need and some of the information you might want.

If you are in the online version of QuickBooks navigate to the “+” sign and then click Journal Entry. In the desktop versions, click the Company menu and then click Create General Journal Entries. From here the process is the same.

Basic Entry for Payroll Expenses

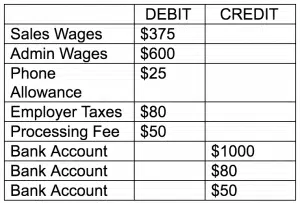

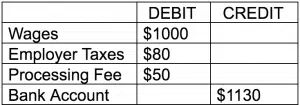

In the most basic form, you will want to debit the various expenses and credit the bank account the payroll company will be pulling funds from. The minimum requirements for a payroll journal entry would be:

Wages include the money the employee takes home and the taxes the employee pays. Employer taxes are just that – only the employer portion of payroll taxes. The payroll service will debit that amount from your bank either all together (as in the example above) or separately (as in the example below).

Building on the Basics of Payroll Expenses

To build out the above journal entry you might consider the below:

- Do you need to separate wages and employer taxes between an expense account (e.g., for admin staff) and a cost of labor account (e.g., for the employees executing the service your company provides)

- If you provide a cell phone allowance or mileage reimbursements for additional reporting clarity you may choose to remove this data from the wage number and break it out separately

More Complex Cases

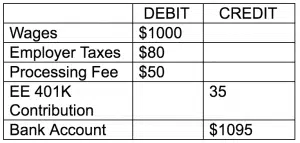

Other payroll providers leave that as the responsibility of the employer. In that case you would want to credit that amount to a liability account when recording payroll expenses.

Then when you pay the money on to the retirement provider you zero out this account by coding the check you write to the same account: EE 401K Contribution.

Other Considerations To Keep In Mind

Other considerations might include the following scenarios:

- Employee loans

- Garnishments

- Uniform deductions

- Health and other insurance deductions

- Employer retirement plan matches or profit-sharing

If you are unsure how to efficiently and effectively record your company’s payroll Szweda Consulting would love to help you and streamline your process to save you time and money. Please contact us for a consultation.