The IRS has released its long-awaited changes to Form W-4. This will affect both accounting and human resource professionals as well as all employees needing to make changes to their tax withholding and those taking new jobs in 2025.

View the new IRS w4 form here.

You don’t have to have all your employees fill out new forms, but you must use the new form for any employees seeking to change their withholding. Additionally, all new hires in 2025 must use the new form.

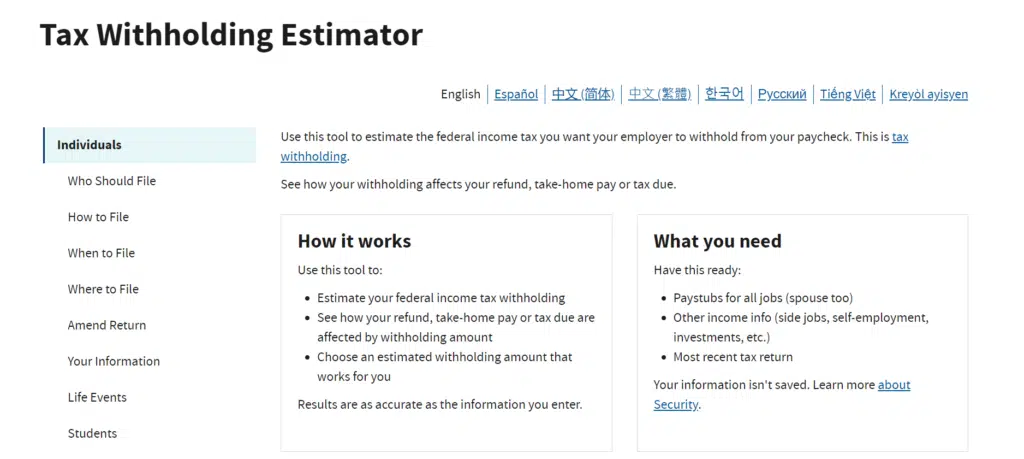

Federal Tax Withholding Calculator

Using the Federal Tax Withholding Calculator

The estimator will give everyone the most accurate withholding but is most useful for individuals with multiple jobs, self-employment income, income from working as an independent contractor (1099) or those seeking to limit the amount of information employers can glean from the W-4.

While a W-4 is intended to be used by employees not subject to self-employment tax, it is possible to use Form W-4 to account for the income you will receive from an employee + self-employment scenario. To do this, you would have to put an amount, as instructed by the Federal Tax Withholding Estimator, on line 4(c) of the new form.

Using the Estimator To Keep Consistent

You can complete the Estimator multiple times throughout the year and resubmit updated W4 forms to your employer as often as necessary. However, the later in the year you attempt to adjust for changes in income, the less useful the Estimator may be owing to there being too little time to make corrections.

Get Help From an Accountant

If you are an employee and need help using the Estimator or if you are an employer and need help communicating changes to your employees let us help you with a solution.

For employers, as we head into 2025, another very useful article to review that we published this year is the one titled Correct W-9 Form Completion and Best Practices. If you need help with Payroll Services or 1099 filings please reach out and the accountants and bookkeepers at Szweda Consulting will be happy to assist you.