So you’ve mastered the basics and reconciled your first bank statement, but you’re wondering if there are any secrets of the software that you might have missed out on.

QuickBooks gets more intelligent the longer you use it. For example, the software remembers how you have categorized things in the past and suggests those accounts in the future. Still, there are some proactive ways to speed up the process and reduce errors. These are even more useful if multiple bookkeepers or people are using QuickBooks.

Set up Recurring Transactions in QuickBooks

Let the automation work for you. Do you invoice a retainer fee to a client with the same amount every month? You can set up recurring invoices that will automatically create the invoice for you each month. The system can also automatically email the invoice to the customer.

Suppose you have the customer’s bank information on file. In that case, you can create a sales receipt instead, which will automatically charge the customer each time the transaction reoccurs.

Do you have a vendor bill that you pay every month for the same amount? For this scenario, you can set up a recurring bill, check, or expense transaction depending on your method of processing bills. This way, even if the mail gets delayed or an email is lost, you’ll still have a reminder that your monthly bill is due.

You can also set up recurring transactions for journal entries. This is useful if you have prepaid insurance expenses and need to expense a portion of them over time. For example, a monthly entry can be set up to reoccur for a set number of times until the expense is fully allocated.

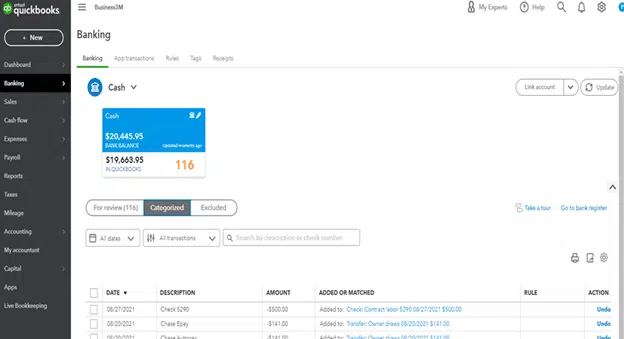

Set up Bank Feed Rules in QuickBooks

You can set up bank feed rules to help speed up the process of categorizing transactions. This can also help other bookkeepers know how you want transactions coded. Do you want Costco purchases always coded as office supplies? GetGo always coded as fuel? You can set this up under Banking Rules.

Have a lot of transactions to code? Just get started. After you code two transactions the same way, QuickBooks will automatically ask if you want to create a rule.

We don’t recommend selecting the Auto-add feature just yet. Software is excellent, but sometimes it can be wrong as rules are triggered based on the bank description. Therefore, we recommend you set up rules, but not auto-add rules. This gives you one more opportunity to glance over the transactions and confirm them before they get entered into the accounting software and become a lot harder to find.

Be Thorough

Fill in every field. You’ll thank yourself later. You never know when you’ll need a report out of QuickBooks, and if you didn’t take the time to put the information into QuickBooks, you wouldn’t be able to get it out.

Fill in the Vendor Name field when categorizing expenses. This information will be helpful when determining who needs to receive a 1099 at year-end. To figure this out, you need to be able to run a report by vendor name to see who was paid more than $600 in the calendar year.

You might also want to know how much you spend with certain vendors. This information is important to bring to the attention of suppliers when you are seeking to expand your credit line with the business, obtain special pricing, or switch vendors to a competitor.

Like with vendors, fill in the customer name. This one is a little tricky as just entering the customer name in the bank feed when categorizing income likely won’t get you the reports you are looking for. You’ll want to make sales receipts or invoices to fully integrate the customer’s name into the software.

This information is essential in many scenarios. For example, an insurance company may want to know who your largest clients are when you are renewing your policies. Likewise, a credit card company may want to know the same information as you seek to expand your relationship with the card issuer.

Finally, the information can be helpful internally. With customer names entered in, your sales team can easily see if sales with a particular customer have dropped off or stopped. Then, you can focus on reaching out to those customers to ensure they are happy with your products and services and try to retain them.

Entering this information takes seconds but can have a significant payoff later on. Make sure you’re doing this yourself or speak to your bookkeeper about keeping track of these things in QuickBooks.

Entering this information can often be done via Bank Feed Rules based on the data coming through the bank description. Make sure the vendor is filled in for any Bank Feed Rules you create. For any Recurring Transactions, you only have to take the time to set it up once, so put in as much information as possible.

Bonus: All About Dates

Are you tired of typing the date on every QuickBooks transaction? At least, hopefully, you’re typing in the date. Hopefully, you’re not letting QuickBooks default to the current day’s date. Each transaction should be dated when the income was earned or expense incurred, not the entry date into QuickBooks.

Also, hopefully, you’re not using the mouse to scroll through the calendar and click on a date, are you? If so, we have a way to really speed up your life. Just follow the chart below.

| Keyboard Entry | Result |

| lowercase “t” | today’s date |

| lowercase “y” | first of the year |

| lowercase “r” | last day of the year |

| lowercase “m” | first day of current month |

| lowercase “h” | last day of current month |

| lowercase “w” | first day of current week |

| lowercase “k” | last day of current week |

| + | plus one day forward |

| – | minus one day backward |